building progress that actually sticks

|

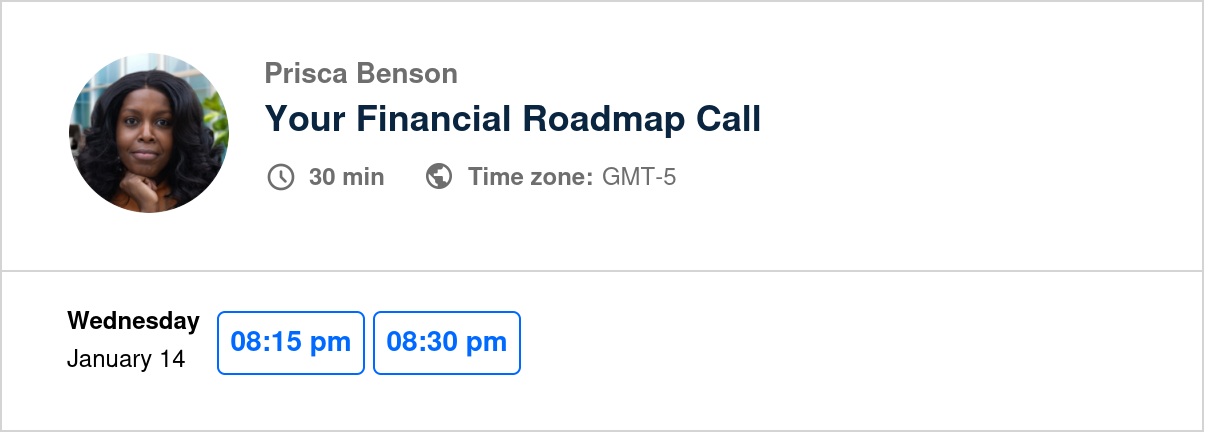

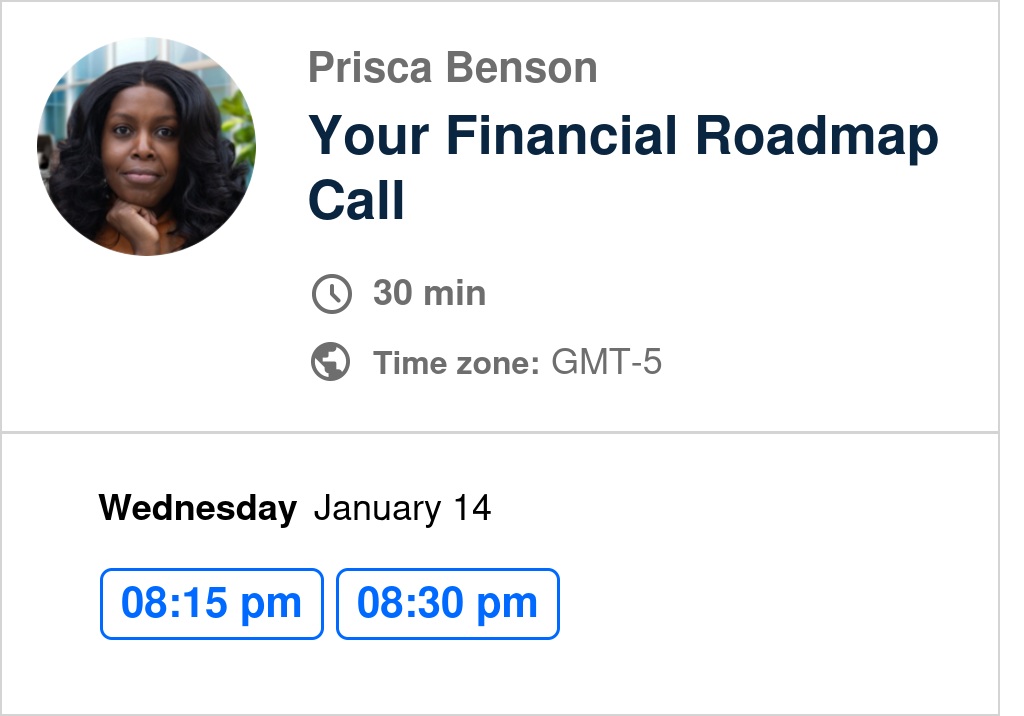

“I’m tired of going backwards.” A client said that to me recently, and it stuck with me because I know how many people feel the same way but don’t always say it out loud. You’re paying bills, making decent money, and still feel like every step forward gets erased by the next expense. It’s exhausting. If that sounds familiar to you Reader, I want you to know this isn’t a personal failure. It’s usually a sign that you don’t have the right system in place yet. Without a clear plan, it’s easy to feel stuck or like you’re running in circles no matter how hard you try. This is exactly what I help my clients work through. We slow things down, get clear on what’s actually happening with your money, and build a plan that helps you move forward instead of back. If you’re ready to stop feeling like you’re losing ground Reader, a Financial Roadmap Call could be the next right step.

🧠 Mindset Shift of the WeekFor a long time, thinking about wealth or riches can feel uncomfortable, especially when money is tied to ideas like greed or selfishness. I've been there! But money itself has no character. It’s simply a tool, and learning to think with a growth mindset can help you stop struggling and start making choices that support the life you want. This perspective is explored beautifully in We Should All Be Millionaires by Rachel Rodgers. 💡 Smart Saving TipWhen something stops working, replacing it often feels like the easiest answer, but it’s usually the most expensive one. Recently, instead of replacing my mom’s phone, I fixed the issue with a simple SIM card switch and saved hundreds of dollars. Imagine catching just a few of these “fix it, don’t replace it” moments each year and keeping that money for goals that actually matter. Here’s a quick example of how this played out in real life and why it’s worth pausing before you replace next time. 📉 Debt-Free Game PlanComparing your debt journey to someone else’s can quietly slow you down. Different incomes, timelines, and responsibilities mean their path was never meant to be yours. When comparison turns into pressure, it drains motivation instead of helping progress. 📈 Investing Made SimpleMaxing out your IRA or workplace retirement plan might sound like a lot, but the earlier and more consistently you contribute, the more time your money has to grow. For example, if you make $80,000 a year and increase your retirement contribution from 4% to 6%, you could end up with over $300,000 more after 40 years. Even small increases matter because your money starts earning money for you over time, not the other way around. Here’s a quick video showing how to calculate what it would take to max out your retirement plans if you want to see it in action. Thanks for letting me be part of your financial journey. Which section was your favorite this week? Hit reply and let me know. I love hearing from you! Eager to see you thrive, Prisca P.S. Found something helpful today? You can drop a little something in my Appreciation Jar if you’d like. Totally optional, as your support in any form means the world. P.P.S. I help women like you create a customized plan for your money that allows you to enjoy life now while saving for your future. Schedule a free call to learn how my coaching can help you. CONNECT WITH ME ON INSTAGRAM Note: This email may contain affiliate or referral links which means I may receive a commission if clicked at no extra cost to you! I appreciate your continued support! |

Hi! I'm Prisca, money coach for professional Millenial women

I help professional women balance their desire to enjoy life now with the need to save for the future without stressing over every dollar.

Last week, we wrapped the Debt Payoff Challenge. Over 50 women joined, ran their numbers, set real payoff dates, and built plans they can adjust when life… does what life does. It was such a joy to lead. I’ll run it again at least one more time this year, so keep your eyes open. On a personal note, I’m getting close to $500K in investments. That number didn’t happen overnight. It’s the result of steady, boring, consistent effort. The past few weeks have been full, with podcast interviews,...

Reader, how often do you check your bank account at the end of the month and think, “Where did all my money go?” You aren't alone. In fact, 65% of Americans have no idea how much they spent last month. Most of us aren't broke, at least not in the true sense. But money has become so intangible that our income slips through the cracks before we can even think about our goals. I once worked with a client who swore she had absolutely no extra money to save. She was making a solid income, but the...

If saving money feels harder than it should Reader, you’re not imagining it. Most people don’t struggle because they’re bad with money. They struggle because they don’t have a system. I see this all the time. I once worked with a client who felt like her paycheck disappeared every month. She was doing her best, but her savings sat at $250 and never moved. Once we put a simple, repeatable plan in place, that $250 grew to $2,500 in just three months. Same income. Different approach. First, I...